Conoce nuestra historia y compromiso | Tradicional

Acerca de AV Villas

History

1972 - The beginning of this great project

It had its origin in the Las Villas Savings and Housing Corporation, an entity created in 1972, specialized and with extensive experience in the financing of the construction sector, through the granting of loans within the UPAC system to both builders and buyers of real estate.

1998 - Member of Grupo AVAL

In 1998, the Bank was controlled by Grupo Aval Acciones y Valores S.A., which is the largest and most important financial group in the country, made up of Banco AV Villas; Banco de Occidente; Banco de Bogotá; the Pension and Severance Administrator; Porvenir S.A. and Banco Popular S.A.

2000 - A Growing Thought and Ideal

At the beginning of the year 2000, the Las Villas Corporation merged to absorb the Savings and Housing Corporation Ahorramas, an entity created in December 1972 and which had become part of the Aval Group in mid-1997. Thus, at the time of the merger, the sixth largest financial institution in the country by level of assets emerged, under the name of AV Villas Savings and Housing Corporation.

Subsequently, Law 546 of 1999 (Housing Law) was issued, which created the Real Value Unit (UVR), replacing the UPAC, and opened the way for the conversion of the CAVs into commercial banks. Therefore, as a result of the Housing Law, and in order to provide a greater diversity of products and services to its customers, in March 2002 AV Villas officially became a Commercial Bank.

TODAY - AV Villas Bank today

Its corporate purpose is to enter into and execute all operations legally permitted to commercial banks, subject to the requirements, restrictions and limitations imposed by law. Its majority shareholder is Grupo Aval Acciones y Valores S.A., which is why it is part of one of the most important financial conglomerates in the country.

Since 2002, the bank has undergone changes on the different fronts of its activity, consolidating its banking vocation through the launch of new products, such as current accounts, foreign exchange operations, consumer loans, free investment, treasury and business loans, without abandoning the traditional lines of savings deposits (accounts and CDTs). as well as individual and builder mortgage loans. In the same way, it has agile and secure electronic channels such as Audiovillas, Internet, ATMs, Pin Pad and payment points, which offer convenience and agility to its customers.

Banco AV Villas is in a creative and consolidation period, which aims at the strategic objective of achieving its growth, for which it has prepared; It has a competitive network of offices, its sales force has been trained and has at its disposal the best technology and efficient administrative support. The philosophy that underlies the Bank's current activity is summarized in the following postulates, disseminated and shared by its employees.

Mission, Vision

Our Mission

To grow alongside our customers and our people, always innovating.

Our Vision

To set the standard in the way of doing banking in a dynamic and innovative way.

Sala de Prensa

La sala de prensa del Banco AV Villas es punto de contacto para los diferentes medios de prensa acerca de los diferentes acontecimientos o noticias que han sido publicadas por el banco.

-

Documentos

-

Diciembre 18: AV Villas se lanza a impulsar la cultura del ahorro con los bolsillos

-

Diciembre 9: GOLAZO: iniciativa de AV Villas y Visa que pone a rodar la pasión de la Copa Mundial de la FIFA™️2026

-

Diciembre 2: AV Villas y Visa lanzan Tarjeta de Crédito edición limitada para los fanáticos del Mundial FIFA 2026

-

Noviembre 28: AV Villas se lanza de lleno con las billeteras Google Pay y Apple Pay

-

Noviembre 13: Más de 2 mil niños con cáncer beneficiados gracias a alianza entre Fundación Sanar niños con cáncer y Banco AV Villas

-

Noviembre 12: Nueva Vicepresidente Jurídica AV Villas

-

Octubre 27: Banco AV Villas celebra 53 años de historia, evolución e innovación financiera en Colombia

-

Octubre 14: AV Villas fortalece su capital de trabajo con emisión de bonos subordinados por COP$50.000 millones

-

Octubre 06: Bre-B, el futuro de los pagos inmediatos llegó a AV Villas

-

Julio 2: AV Villas acerca Bre-B a las empresas de servicios públicos

-

Junio 18: Nueva Vicepresidente de Servicios Corporativos en AV Villas

-

Junio 11: AV Villas lanza opciones de ahorro para invertir la prima con tasa de hasta 10,5%

-

Mayo 21: AV Villas abre oportunidades de trabajo en varias ciudades del país

-

Mayo 9: AV Villas presenta herramienta digital que mejora la gestión de los municipios

-

Abril 30: AV Villas lanza bolsillos con rentabilidad para incentivar el ahorro

-

Marzo 27: Asamblea de Accionistas AV Villas: 2024, un año de cambios y crecimiento.

-

Marzo 12: Value and Risk confirmó máximas calificaciones a AV Villas

-

Marzo 4: Banco AV Villas entrega biblioteca y centro de cómputo en Rancherías de La Guajira

-

Enero 27: Nuevo Vicepresidente Regional Suroccidente Banco AV Villas

-

Enero 15: Nueva Gerente Nacional de Banca Oficial e Institucional del Banco AV Villas

-

Enero 14: Nuevo Vicepresidente Comercial en Banco AV Villas

-

Our Commitment

AV Villas sustainability

-

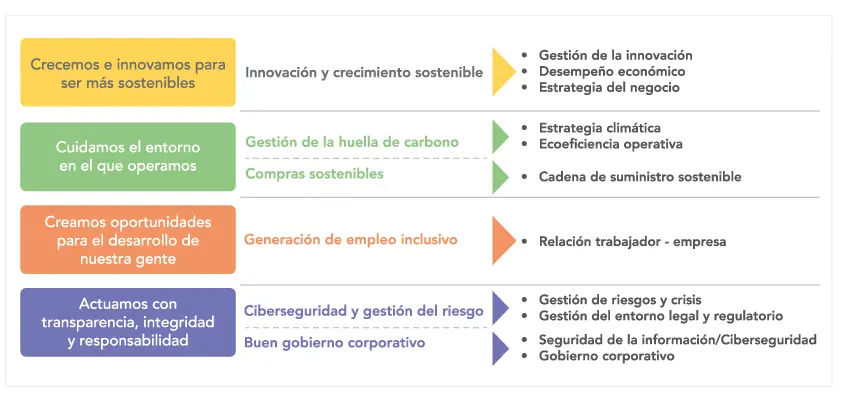

In 2023 we updated our Sustainability Model from the dual materiality approach. This process made it possible to identify the impacts and opportunities in social, environmental and governance matters from a perspective of the environment towards the organization and from the organization to society, the economy and the environment, including the vision of stakeholders.

Our Sustainability Model is the reflection of the conviction of developing the business in a sustainable way and thus adding value to stakeholders, not only in the present, but in the long term. To achieve this purpose, we are guided by 4 strategic fronts that demonstrate our real commitment to the conscious progress of the country.

From strategy to action - materiality

Within each of the 6 pillars of the Model, we integrate the corresponding material issues, defined by the different stakeholders, as follows:

Alianzas y Membresías

-

-

-

-

-

-

-

-

Financial consumers will have, during all times of their relationship with Banco AV Villas, the following rights:

- In accordance with the principle of due diligence, financial consumers have the right to receive products and services with safety and quality standards from Banco AV Villas, in accordance with the conditions offered and the obligations assumed by Banco AV Villas.

- To have at their disposal, under the terms established in this law and in the other special provisions, transparent, clear, truthful, timely and verifiable publicity and information on the characteristics of the products or services offered and/or supplied. In particular, the information provided by Banco AV Villas must be such that it allows and facilitates its comparison and understanding with respect to the different products and services offered in the market.

- To require due diligence in the provision of the service by Banco AV Villas.

- To receive adequate education regarding the different ways of implementing the products and services offered, their rights and obligations, as well as the costs that are generated on them, the markets and type of activity carried out by Banco AV Villas, as well as the various protection mechanisms established for the defense of their rights.

- Respectfully submit queries, petitions, requests, complaints, or claims to Banco AV Villas, the Financial Consumer Ombudsman, the Financial Superintendence of Colombia and self-regulatory bodies.

- The other rights established in Law 1328 of 2009 or in other provisions, and those contemplated in the instructions issued by the Financial Superintendence of Colombia.

-

To file a claim or application with our Bank, you only need:

- Call our Service Line (Audiovillas) and tell us your concern at the following numbers:

TELÉFONO CIUDAD Linea única 018000518000 Nacional Audiovillas Transacciones (601) 3363199 Bogotá Audiovillas Servicio al Cliente (601) 4441777 Bogotá Audiovillas (604) 3256000 Medellín Audiovillas (602) 8859595 Cali Audiovillas (605) 3304330 Barranquilla Audiovillas (607) 6302980 Bucaramanga Online Chat: www.avvillas.com.co

The response will be delivered by two means:

- To the registered email.

- Or through any branch of the Bank

-

The following are good practices for financial consumers' self-protection:

- Verify that the entity with which they wish to contract or use the products or services is authorized and supervised by the Financial Superintendence of Colombia.

- To find out about the products or services that you intend to purchase or use, inquiring about the general conditions of the operation; that is, the rights, obligations, costs, exclusions and restrictions applicable to the product or service, requiring the necessary, precise and sufficient verbal and written explanations that enable informed decision-making.

- Observe the instructions and recommendations given by the supervised entity on the management of financial products or services.

- Review the terms and conditions of the respective contract and its annexes, as well as keep the copies provided of said documents.

- To find out about the bodies and means available to the entity to present petitions, requests, complaints or claims.

- Get a timely response to every product or service request.

The failure of financial consumers to exercise their own protection practices does not imply the loss or disregard of their rights vis-à-vis the supervised entities and the competent authorities. Similarly, it does not exempt supervised entities from the special obligations enshrined in Law 1328 of 2009 with respect to financial consumers.

Financial consumers will have the duty to provide true, sufficient and timely information to Banco AV Villas and the competent authorities in the events in which they request it for the due fulfillment of their duties and to update the data that require it. In the same way, they will inform the Financial Superintendence of Colombia and the other competent authorities about entities that provide financial products or services without being legally authorized to do so.

-

Banco AV Villas has the following special obligations:

- To provide information to the public regarding the Financial Consumer Ombudsmen, in accordance with the instructions given on this matter by the Financial Superintendence of Colombia.

- Deliver the product or provide the service properly, that is, under the conditions informed, offered or agreed with the financial consumer, and use adequate standards of safety and quality in the supply of the same.

- Provide understandable information and transparent, clear, truthful, and timely advertising about its products and services offered in the market.

- To have a Financial Consumer Service System (SAC), in the terms indicated in this law, in the decrees that regulate it and in the instructions issued in this regard by the Financial Superintendence of Colombia.

- Refrain from engaging in conduct that entails contractual abuses or from agreeing to clauses that may affect the balance of the contract or give rise to an abuse of a dominant contractual position.

- Prepare the contracts and annexes that regulate relations with customers, clearly, in characters legible to the naked eye, and make them available to them for acceptance. A copy of the documents that support the contractual relationship must be available to the respective client, and will contain the terms and conditions of the product or service, the rights and obligations, and the interest rates, prices or rates and the way to determine them.

- Refrain from making unagreed or uninformed charges to the financial consumer, in accordance with the terms established in the regulations on the matter, and have at their disposal the receipts or supports of payments, transactions or operations carried out through any channel offered by Banco AV Villas. The conservation of such receipts and supports must comply with the regulations on the matter.

- Refrain from making any charge for pre-judicial collection expenses without having carried out a real activity effectively aimed at such management, and without having previously informed the financial consumer of the value of the same. Collection procedures must be carried out respectfully and at appropriate times.

- Keep the information provided by the financial consumer confidential and that is confidential in the terms established in the corresponding regulations, without prejudice to its provision to the competent authorities.

- Provide proof of the status and/or specific conditions of the products on a specific date, when the financial consumer requests it, in accordance with the procedure established for this purpose, except in those cases in which Banco AV Villas is obliged to do so without the need for prior application.

- Attend to and respond in a timely manner to requests, complaints, or claims made by financial consumers, following the procedures established for this purpose, the provisions enshrined in this law, and in the other applicable regulations.

- Provide human, physical, and technological resources so that branches and agencies provide efficient and timely service to financial consumers.

- Allow its customers to consult the status of its products and services free of charge, at least once a month, through the channels indicated by Banco AV Villas.

- Have a link on its website to the site of the Financial Superintendence of Colombia dedicated to the financial consumer.

- Report to the Financial Superintendence of Colombia, in the manner indicated by the latter, the price of all products and services that are offered on a massive basis. This information must be permanently disclosed by Banco AV Villas in its branches, ATMs in its network and its website.

- Inform financial consumers, within the deadlines indicated by the Financial Superintendence of Colombia, through the respective channel and prior to carrying out the operation, the cost of the same, if any, providing them with the possibility of carrying it out or not.

- Have the appropriate electronic means and controls to provide efficient security to transactions, to the confidential information of financial consumers and to the networks that contain it.

- Collaborate in a timely and diligent manner with the Financial Consumer Ombudsman, the judicial and administrative authorities and self-regulatory bodies in the collection of information and the obtaining of evidence, in cases that are required, among others, those of fraud, theft or any other conduct that may constitute a punishable act carried out through the use of credit or debit cards, the performance of electronic or telephone transactions, as well as any other modality.

- Not to require the financial consumer to provide information that is already stored in Banco AV Villas or in its dependencies, branches or agencies, without prejudice to the obligation of the financial consumer to update the information that in accordance with the corresponding regulations so requires.

- Develop financial education programs and campaigns for its customers on the different products and services they provide, their obligations and rights and the costs of the products and services they provide, markets and types of supervised entities, as well as the different mechanisms established for the protection of their rights, according to the instructions given for this purpose by the Financial Superintendence of Colombia.

- The others provided for in Law 1328 of 2009, the concordant, complementary, regulatory rules, those that derive from the nature of the contract entered into or the service provided to financial consumers, as well as from the instructions issued by the Financial Superintendence of Colombia in the performance of its functions and the self-regulatory bodies in their regulations.

-

The Colombian Financial System is made up of different types of Entities, among which we find the following:

Credit Establishments:- Banking Establishments – Banco AV Villas is part of this market.

- Financial Corporations.

- Financing Companies.

- Financial Cooperatives.

Financial Services Companies:

- Trust companies.

- General Deposit Warehouses.

- Pension and Severance Fund Administrators.

- Exchange Intermediation and Special Financial Services Companies.

- Capitalization Companies.

Insurance Companies and Intermediaries:

- Insurance Entities

- Insurance Companies.

- Insurance Cooperatives.

- Reinsurance Companies.

- Insurance Intermediaries

- Runners

- Agencies

- Agents

- Reinsurance Intermediaries

- Reinsurance Brokers

-

Educación Financiera

Tenemos información útil para proyectar tu vida y tu dinero.

Método 90-10 para ahorrar

Cumple tus metas de ahorro con nuestro método 90-10, veras resultados al corto, mediano y largo plazo .

Construir presupuesto

Te enseñamos cómo construir un presupuesto efectivo y lograr tus metas financieras.

Compras por Internet

Te enseñamos cómo hacer compras en línea de manera segura y asi proteger tu información financiera.

-

Avanzando Virtual

2026

Enero - Organiza tu presupuesto

Febrero - Crea un plan de ahorro para cumplir metas

Marzo - Conoce y aprovecha las líneas de Crédito

2025

Enero - Armar un presupuesto en 3 pasos

Febrero - 4 hábitos para comprar con seguridad por internet

Marzo - Llegó el momento de organizar el bolsillo personal

Abril - ¡Ojo que así roban tu información!

Mayo - Diferencias entre fechas clave de una Tarjeta de Crédito

Junio - ¿Gastar o invertir la prima? Esa es la cuestión

Julio - Consejos financieros para cuidar a tu mascota

Agosto - Datos que NUNCA debes ENTREGAR en una llamada

Septiembre - La Ingeniería Social: el arte de manipular

Octubre - 5 hábitos para beneficiarse del ahorro

Noviembre - 5 tips para aprovechar los descuentos de noviembre

Diciembre - Para una Navidad soñada cuida tus finanzas

2024

Enero -HACER UN PRESUPUESTO TE AYUDA A MINIMIZAR GASTOS

Febrero -Emprender en cinco pasos

Marzo - 5 estrategias para que los jóvenes ahorren

Abril - ¿Sabes para qué sirve una Cuenta de Nómina?

Mayo - ¿Sabes cuidar tu información financiera y personal?

Junio - ¿Cómo invierto mi Prima de mitad de año?

Julio - Los “gota a gota” en la era digital

Agosto - 5 formas de financiar un emprendimiento

Septiembre - ¿Qué ganas por estar al día con tus créditos?

Octubre - Servicios públicos: cómo ahorrar dinero

Noviembre - Tres hábitos para aprovechar los descuentos pre-Navidad

Diciembre - ¿Cómo protegerte de los programas maliciosos?

2023

Enero - ¿Qué debe incluir un presupuesto?

Febrero - Cinco ventajas de usar la Banca Digital

Marzo - Ahorra como un inversionista

Abril - Cómo entender la Tasa de Interés en un Crédito

Mayo - “Llamadas Peligrosas”: cómo identificarlas

Junio - La Prima: impulso financiero para emprender

Julio - ¿Has escuchado de los Bolsillos Digitales?

Agosto - Lo que ganas por ser “buena paga”

Septiembre - ¿Qué ganas con revisar cada mes tu Presupuesto?

Octubre - Regla de oro que todo ahorrador necesita saber

Noviembre - 5 mandamientos para una compra exitosa en comercio electrónico

Diciembre - 5 precauciones al comprar por internet

2022

Enero - 5 pasos para construir un presupuesto

Febrero - 4 pasos para identificar si quieren robarte tus datos

Marzo - Consejos para que jóvenes utilicen bien el “billetico”

Abril - La información personal vale oro

Mayo - ¿Sabes cuáles son las opciones para ahorrar?

Junio - 5 Tips para “Gozarte” la prima

Julio - 5 consejos para comprar vivienda

Agosto - ¿Cómo saber si debe Declarar Renta?

Septiembre - Alertas de Virus en tu smartphone o computador

Octubre - ¿Cómo mantener el impulso de ahorrar?

Noviembre - ¿Cómo entender el Extracto Bancario de un Crédito?

Diciembre - Disfrutar las fiestas de fin de año con seguridad

2021

Enero - Nunca entregues tu información personal

Febrero - Disfruta los beneficios de hacer tu propio presupuesto

Marzo - ¿Cómo sacar provecho del dinero?

Abril - Estos datos de tus Tarjetas debes “súper” cuidar

Mayo - Atención a las llamadas fraudulenta

Junio - El valor de la Prima en las finanzas del hogar

Julio - ¿Cómo identificar un ataque de phishing?

Agosto - Cómo saber si tienes que Declarar Renta

Septiembre - Leasing Habitacional: opción real para ser propietario

Octubre - Identifica los gastos “tóxicos”

Noviembre - 5 consejos para cuidar tu Tarjeta Débito

Diciembre - ¿Cómo realizar compras seguras por internet?

ABC de la economía de bolsillo

Método de Ahorro 90 – 10

¿Quieres tener buenos hábitos económicos?

Ayudas para recordar las fechas de pago de tus obligaciones

Con una mano ahorras o inviertes

¿Cómo hablar y definir el presupuesto con la familia?

Opciones para estar al día con las obligaciones

-

Consumidor Financiero es todo Cliente, Usuario o Cliente Potencial de las Entidades vigiladas por la Superintendencia Financiera de Colombia. Aquí encontrará información importante que le servirá de apoyo para conocer el funcionamiento del Sector y las reglas que rigen la protección del Consumidor Financiero.